Situation

Large Institutional clients see wider spreads than “prime of prime clients” because institutional flow is more challenging to monetize for Liquidity providers.

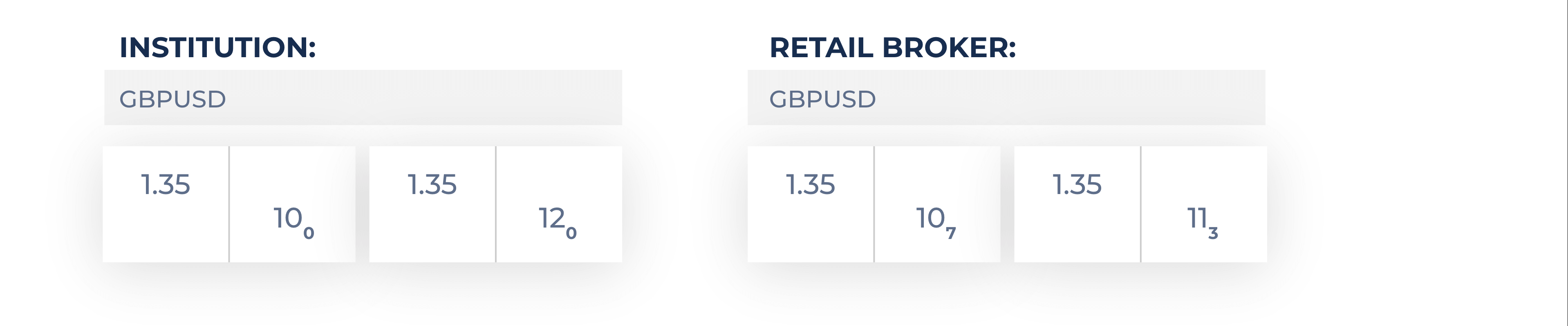

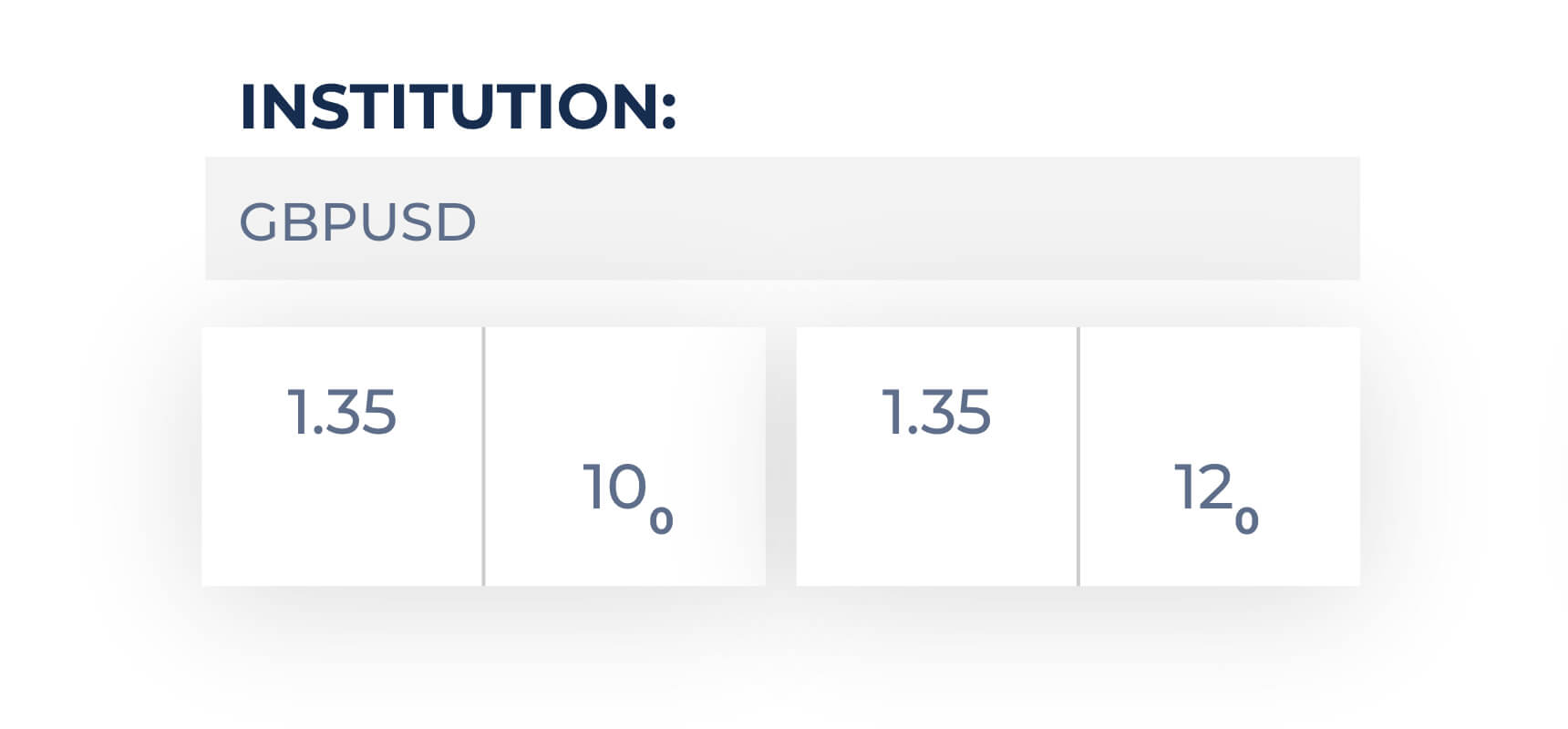

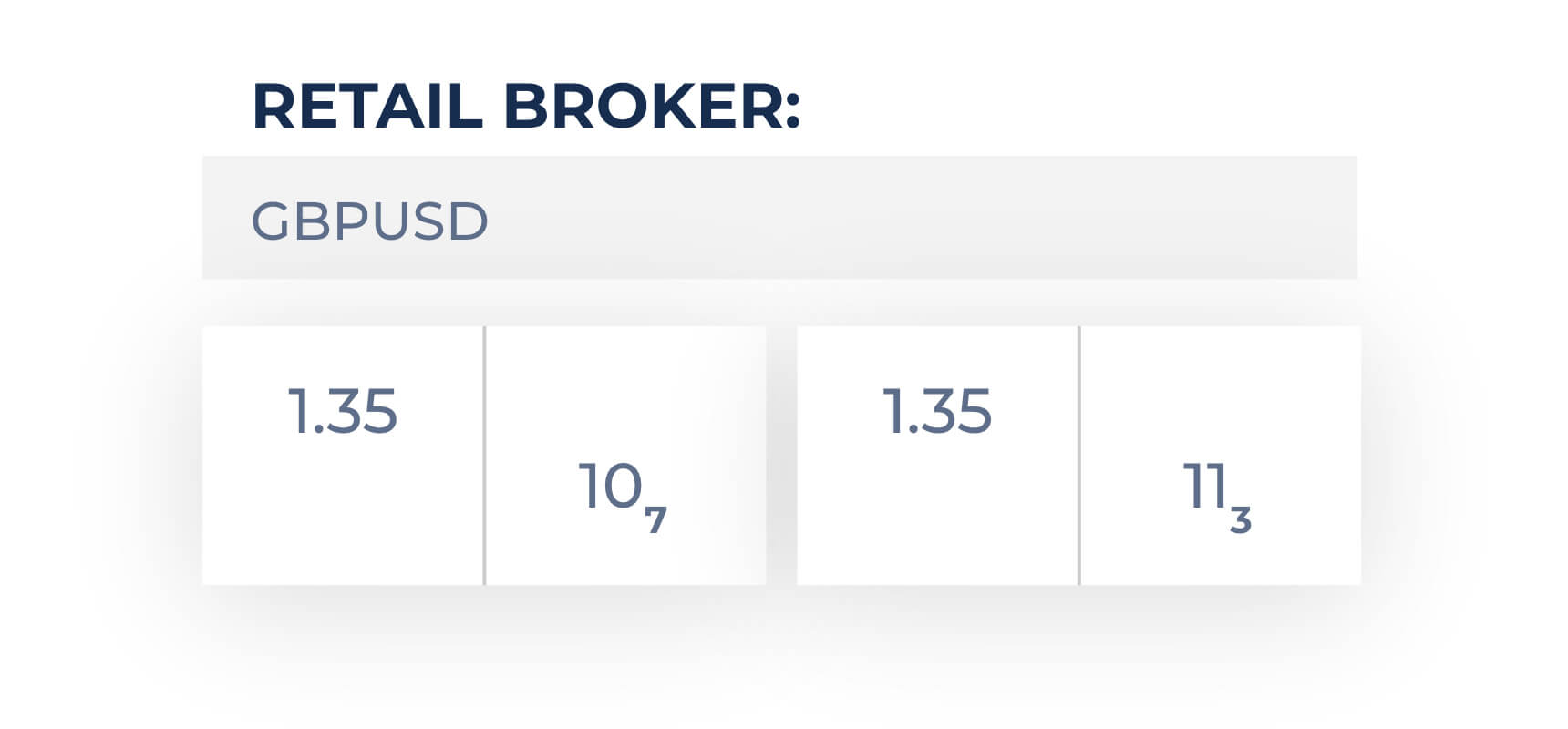

For institutions EURUSD is around 1pip, GBPUSD around 2pips while retail market makers see aggressive 0.1/03 in EURUSD and 0.5/08 in GBPUSD type spreads.

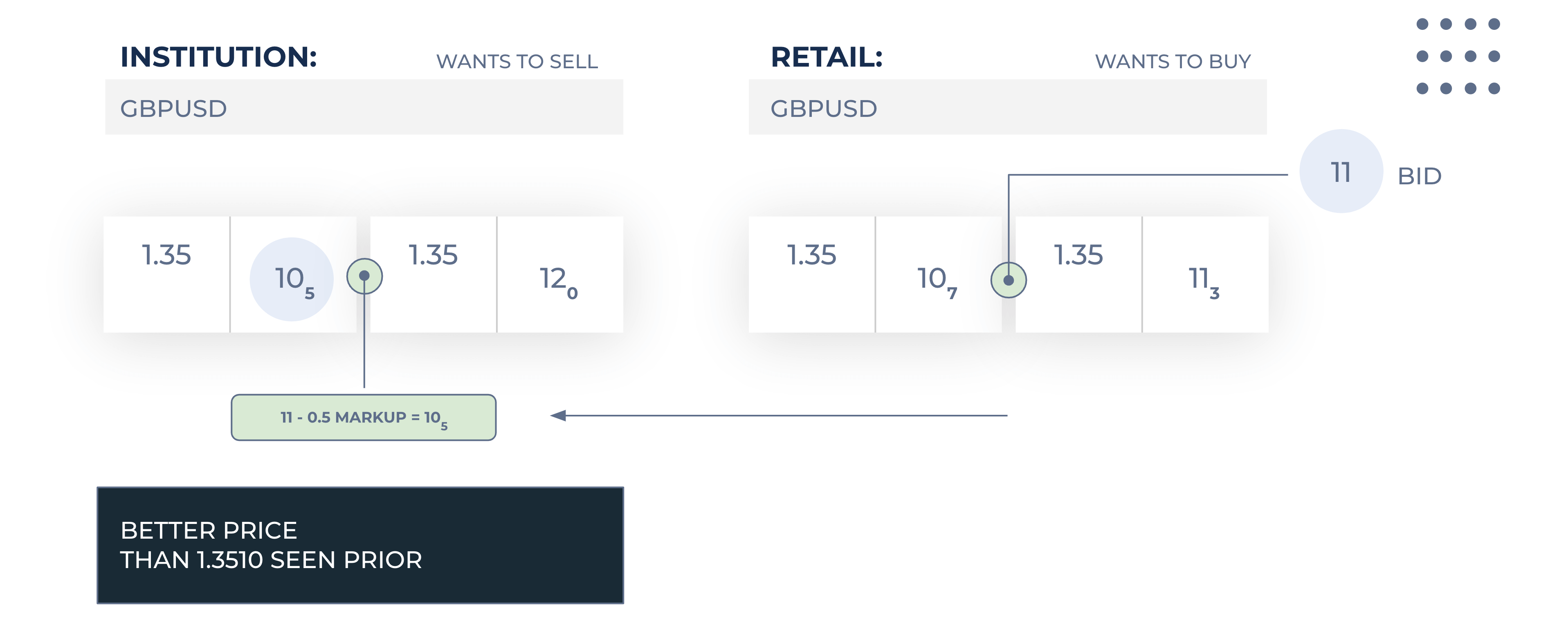

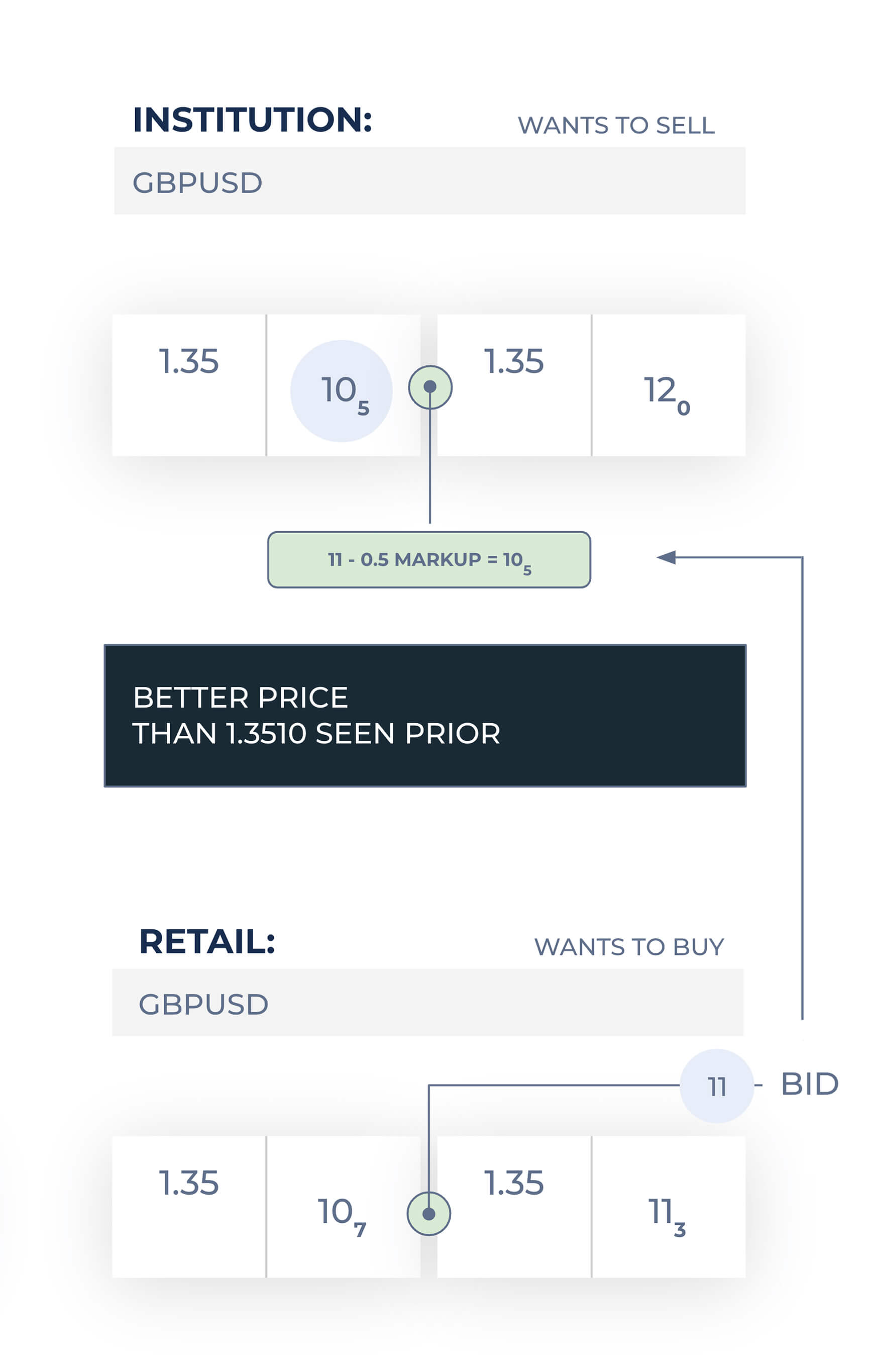

The Retail broker wants to buy – rather than pay the offer at 1.35113, Minerva puts a limit to buy or bid at the mid spread 1.3511 on MFP Trading’s institutional platform.

MFP might show 1.3511 minus a 0.5 markup or 1.13105 to institutions who were previously seeing 1.3510 bid as their best price.

Institutions will find 1.13105 to be a very attractive price to sell at as it is 0.5 better than the 1.3510 bid they had in front of them before Minerva’s price.

Result

Institutions will trade with the MFP platform at 1.35105 saving 0.5 vs the 1.3510 they were seeing before.

The retail broker saves 0.3 in execution costs as it bought at 1.3511 instead of 1.35113.

In this example, MFP makes 0.5 from the markup or roughly $50 per m – After clearing, IT and sales costs, MFP can pay up to $20 per m with a 50% profit share.

Total savings through this approach are $80 per m in this example compared to the typical “pay the spread” approach.

Note that MFP maximizes revenues per client and can make much more than 0.5 in many cases, like with emerging market currencies. Payouts are higher in those scenarios.

Contact us below to schedule a product demonstration

The MFP Trading website is provided exclusively for the use and information purposes of Professional Clients or Eligible Counterparties (“ECP”), as defined by Annex II to “Markets in Financial Instruments Directive” 2004/39/EC (“MiFID”), whether already existing or prospective professional clients. The content is not to be viewed by or used with individual or private investors (known as “Retail Clients” as defined by MiFID). The MFP Trading products and services are not suitable for Retail Clients. If you are not a Professional Client or Eligible Counterparty, you are kindly asked to leave this website by clicking the Back button.

By accessing this website; you hereby acknowledge that this website is intended only for persons that qualify as Professional Clients or Eligible Counterparties only. You also certify possessing the necessary experience, knowledge and expertise required to apprehend the risks inherent to high risk financial instruments referred to herein (i.e. Contracts for Difference Spot Forex financial instruments) and to make your own investment decisions.

The information on this website and our services are not directed at residents of the United States of America or US persons, Canada, Australia, Belgium and is not intended for distribution to, or use by, any person in any jurisdiction where the distribution of or use of Forex/CFD trading is restricted, prohibited or contrary to local law or regulation.

I confirm that I qualify as Professional Client or Eligible Counterparty under the rules and legislations of the Financial Conduct Authority and MiFID respectively, and I have read and understood the Legal & Regulatory information and Privacy & Cookie Statement.